..

Read more »

Child Tax Credit (CTC)

Posted by: Workmytaxes | Jan 26, 2023

Child Tax Credit (CTC) Temporary changes made to the nation’s tax laws as part of a coronavirus relief package in 2021, resulted in many Americans receiving additional Child Tax Credit relief in monthly payments. For the year 2023, these credits have gone through a reset. Before we dive into the changes, let us understand what...

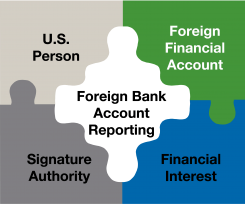

Report of Foreign Bank and Financial Accounts (FBAR)

Posted by: Workmytaxes | Jan 13, 2023

What is an FBAR As Per the Bank Secrecy Act, every year you must report certain foreign financial accounts to the Treasury Department and keep records of those accounts. You report the accounts by filing a Report of Foreign Bank and Financial Accounts (FBAR) on Financial Crimes Enforcement Network (FinCEN) Form 114. Those who must...

..

Read more »

Individual Taxpayer Identification Number (ITIN)

Posted by: Workmytaxes | Jan 05, 2023

Individual Taxpayer Identification Number (ITIN) What is an ITIN An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service. The IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have and are not eligible to obtain a...

..

Read more »

BITCOIN

Posted by: Workmytaxes | Jan 29, 2018

Bitcoin is a crypto currency and worldwide payment system. It is the first decentralized digital currency, as the system works without a central bank or single administrator. The network is peer-to-peer and transactions take place between users directly, without an intermediary. Bitcoin is pseudonymous, meaning that funds are not tied to real-world entities but rather bitcoin addresses. Owners of bitcoin addresses are not explicitly identified, but...

..

Read more »

New Tax Law – How will it Impact you?

Posted by: Workmytaxes | Jan 17, 2018

As you all know, The President has signed into law on December 22, 2017, represents the most significant changes in tax law in more than 30 years. Whether you gain or loose from the taxes, you will be interested in knowing how these will impact you: Here is the gist: Standard deduction and Exemption •...

..

Read more »

You May Need to File India Taxes – Why?

Posted by: Workmytaxes | Jul 07, 2017

If you are an NRI (Non Resident Indian), you need to file your income tax returns if you fulfill any of these conditions: Your taxable income in India during the year was above the basic exemption limit, i.e. Rs. 250,000 You have earned short-term or long-term capital gains from sale of any investments or assets,...

If you are an NRI (Non Resident Indian), you need to file your income tax returns if you fulfill any of these conditions: Your taxable income in India during the year was above the basic exemption limit, i.e. Rs. 250,000 You have earned short-term or long-term capital gains from sale of any investments or assets,.....

Read more »

Filing 2016 Taxes: Read Why Tax Returns get Audited?

Posted by: Workmytaxes | Feb 27, 2017

An IRS audit is a review/examination of an organization’s or individual’s accounts and financial information to ensure information is reported correctly according to the tax laws and to verify the reported amount of tax is correct. Taxes are complex and gray areas abound. So, if you think that you filed taxes and reported everything, still...

An IRS audit is a review/examination of an organization’s or individual’s accounts and financial information to ensure information is reported correctly according to the tax laws and to verify the reported amount of tax is correct. Taxes are complex and gray areas abound. So, if you think that you filed taxes and reported everything, still.....

Read more »

FBAR Filing Deadline changed to April 15th from 2016 filing

Posted by: Workmytaxes | Jan 30, 2017

Please note: The due date for Financial Bank and Financial Accounts FBAR Filing for financial accounts maintained during calendar year 2016 is April 18, 2017, consistent with the Federal income tax due date. This date change was mandated by the Surface Transportation and Veterans Health Care Choice Improvement Act of 2015. The Act also mandates...

Please note: The due date for Financial Bank and Financial Accounts FBAR Filing for financial accounts maintained during calendar year 2016 is April 18, 2017, consistent with the Federal income tax due date. This date change was mandated by the Surface Transportation and Veterans Health Care Choice Improvement Act of 2015. The Act also mandates.....

Read more »